uber eats tax calculator australia

If you drive for Uber and Uber Eats you will need to be registered for GST and pay GST on both your rides with Uber and food delivieries. The current rates are as follows.

Why Uber Eats Will Eat You Into Bankruptcy

Hello Everyone In this video I explain how to calculate GST Goods Services Tax for ride sharing services in Australia.

. If you need any assistance. You can find tax information on your Uber profile well provide you with a monthly and annual Tax Summary. Please provide income and Expenses to get the right calculation.

For purposes of this tax calculator just use the total money you actually received from Uber for the year. Please note that you must enter your ABN details correctly. Rate of 72 cents per kilometre which gives a maximum deduction of 72c x 5000km 3600.

After you enter those two things youll see two numbers. Weekly Fortnightly Monthly Quarterly. However like any other occupation standard GST rules apply and if you earn over 75000 per year from your food delivery activities youre required to register for GST.

Find the best restaurants that deliver. Order food online or in the Uber Eats app and support local restaurants. This is a general overview of what I do for taxes using turbo tax to prepare and file.

Every UBER driver must register with the Canada Revenue Agency and provide the agency with. A look at how I do my taxes as an independent contractor for UberEats. If you are leasing your car to drive for Uber you can.

This calculator will help you work out what money youll owe HMRC in taxes from driving for Uber. Uber GST Calculator is a free tool available for Uber drivers to calculate their. Get contactless delivery for restaurant takeaway groceries and more.

Enter your ABN details into the field marked Australian Business Number ABN. Here are some fees and factors that can. Please select Income Type.

Tick the box to confirm you are registered for GST. You simply take out 153 percent of your income and pay it towards this tax. Fill in the get your refund now form to have an expert will call you and get your same-day refund or if you have any questions related to MyTax mygov and Online tax return you.

This calculator helps you to calculate the tax you owe on your taxable income for the full income year. In others you will see an estimated fare range. In most cities your cost is calculated up front before you confirm your ride.

Driving for Uber and Uber Eats. It can be used for the 201314 to 202122 income years. How prices are estimated.

The uber eats tax calculator the last part of this series has a place where you can plug in all your information and get an idea how your business profits will impact your total tax. The provincial tax rate is 5. Rate of 81 cents per.

Your annual Tax Summary should be available around mid-July. To Calculate UBER GST using ALITAX. There are two taxes that youll likely be charged.

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

My Uber Income Income App For Uber Drivers In Australia

A Tax Guide For Uber Eats Drivers My Tax Refund Today

How To Do Your Taxes For Uber Eats Partners In Australia Youtube

Uber Driver Tax Deductions For 2022 All Your Questions Answered Wealthvisory

Understanding Uber Lyft Tax Deductions 2021 Youtube

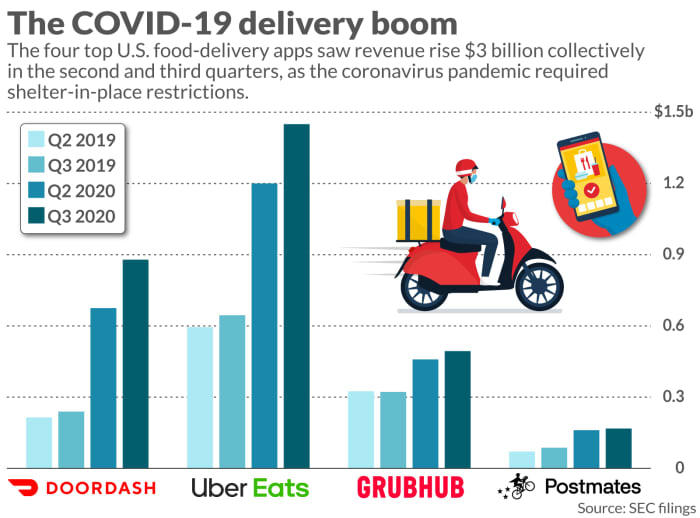

The Pandemic Has More Than Doubled Food Delivery Apps Business Now What Marketwatch

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

How Much Is The Lowest Salary In The Usa What Is The Basic Salary In Us Quora

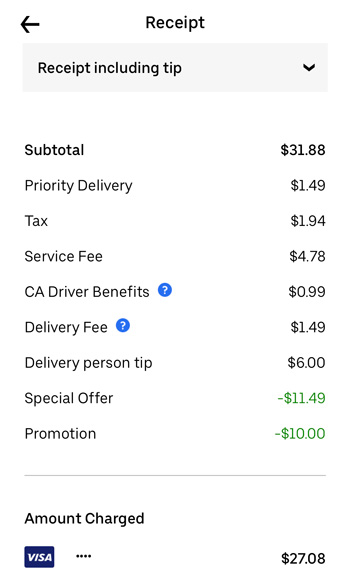

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

Uber Eats Riders Earning As Little As 5 For Deliveries Crossing Multiple Nsw Suburbs Uber The Guardian

Tax Information For Driver Partners

My First Month As An Uber Eats Driver Worked Out Just Fine R Uberdrivers

New Ubereats Cyclist Tax Question For The Uk R Ubereats

Box Of 20 Till Rolls For The Epson Tm M30 Uber Eats 80x80mm Thermal Paper Rolls Ebay

Uber Gst And Tax Calculator Alitax Youtube