food tax jefferson parish

Request to Renew Jefferson Parish Sales Tax Certificates. The following are services provided to Jefferson Parish citizens during this time.

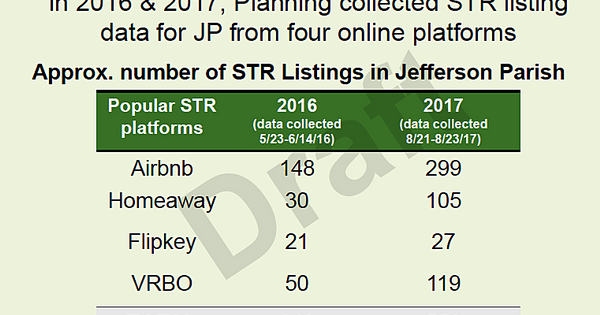

Extra Income Or Neighborhood Nuisance Short Term Rental Rules Weighed In Jefferson Parish Local Politics Nola Com

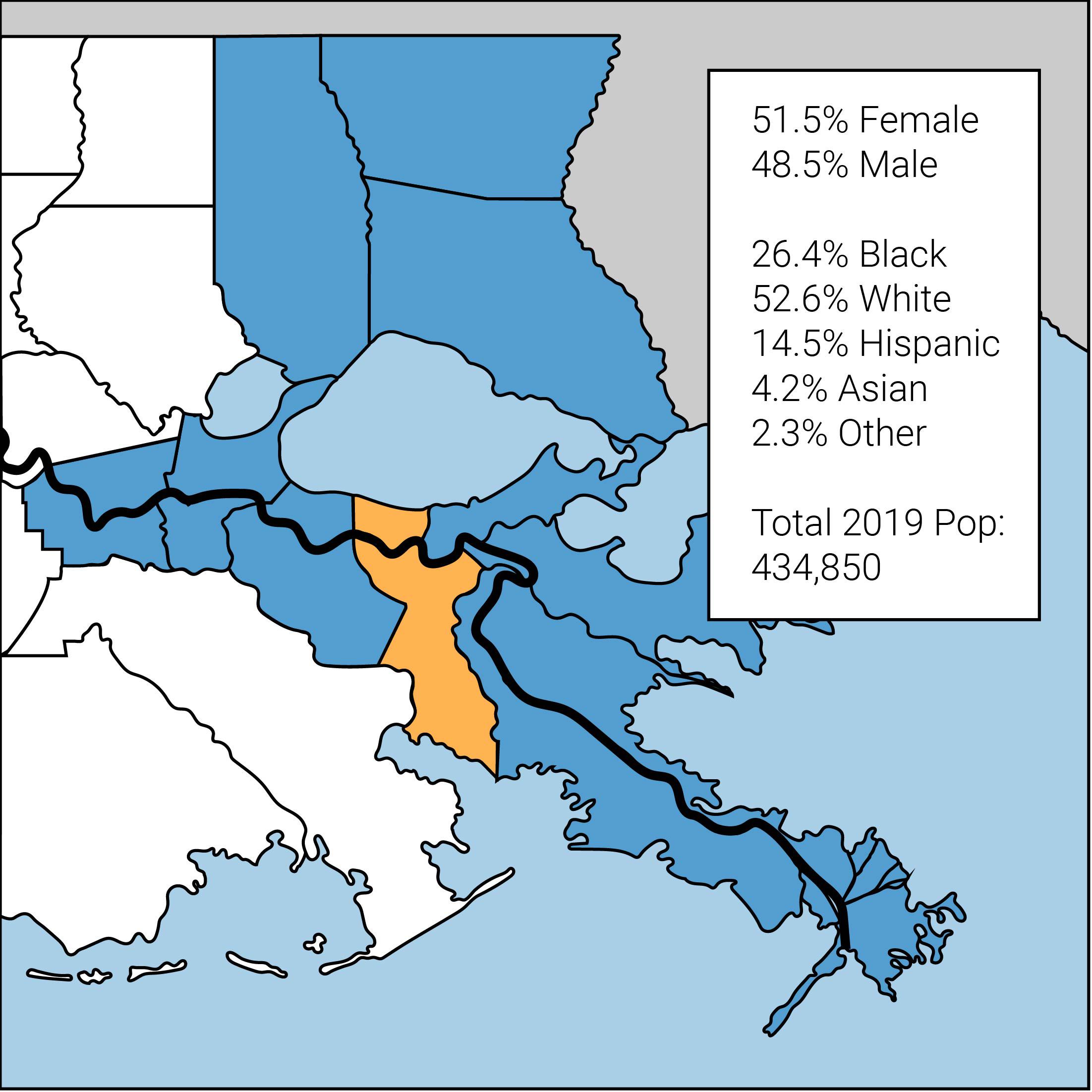

There are 2 Food Stamp Offices in Jefferson Parish Louisiana serving a population of 437038 people in an area of 296 square miles.

. The parish is named for Founding Father Thomas Jefferson. The link below will take you to the Jefferson Parish Sheriffs office Forms and Tables page of their Web site. JEFFERSON LA The Louisiana Department of Children and Family Services DCFS received federal approval on January 27 2021 to begin virtual Disaster Supplemental Nutrition Assistance Program DSNAP operations in Jefferson Parish to provide additional food aid to families affected by Hurricane Zeta.

It has been projected upwards of 4 to 6 financial growth. Louisiana is ranked 1929th of the 3143 counties in the United States in order of the median amount of property taxes collected. The application process will run in a.

Heres how Jefferson Davis Parishs maximum sales tax rate of 995 compares. A caterer in Jefferson Parish who delivers food to a customer in Orleans Parish must collect the tax on that sale. 1221 Elmwood Park Blvd Suite 403.

The Jefferson Parish Sales Tax is 475. For sales over 500000---75. There is 1 Food Stamp Office per 218519 people and 1 Food Stamp Office per 147 square miles.

File and pay state taxes electronically through the Department of. Jefferson Parish Louisiana Sales Tax Rate 2022 Up to 92. Sales Tax 13 Taxable Sales Column 1.

General Sales 13 01 Gross Sales of Tangible Personal Property Leases Rentals and Services See instructions on Reverse Side 01 11 Total Allowable Deductions Line 2 thru Line 10 11. None of the cities or local governments within Jefferson Parish collect additional local sales taxes. The Louisiana state sales tax rate is currently.

475 on the sale of general merchandise and certain services. Tion franchise and withholding taxes. See Jefferson Parish Code of Ordinances Section 35-71 473013j Purchases of electric power or energy or natural gas for use by paper or wood products manufacturing facilities.

Manufacturing machinery and equipment only. 35 - Food Drug items. Rate of tax For sales 200000 to 499999---5.

Some cities and local governments in Jefferson Davis Parish collect additional local sales taxes which can be as high as 05. Has impacted many state nexus laws and sales tax collection requirements. A business that prepares food in Orleans Parish but sells or serves it only outside Orleans Parish or the airport does not collect the tax.

What is the rate of Jefferson Parish salesuse tax. 3 - Occupancy Tax - Eastbank 2 2 - Occupancy Tax - Westbank 2 2 - Airport District 1 Sales Use Tax Listings all rates and levies of sales taxes are parish-wide except for the Airport Tax District This in addition to the 375 hotel. In Louisiana Jefferson Parish is ranked 31st of 64 parishes in Food Stamp Offices per capita and 1st of 64 parishes in Food.

The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. The Jefferson Davis Parish Sales Tax is 5. The following local sales tax rates apply in Jefferson Parish.

To review the rules in Louisiana visit our state-by-state guide. Formerly Food Stamps Family Independence Temporary Assistance Program FITAP Kinship Care Subsidy Program KCSP or Child Support Enforcement Services programs. If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to order one online or contact the Bureau of Revenue and Taxation 504 363-5710 for a tax research certificate.

Jefferson Parish collects a 475 local sales tax the maximum local sales tax allowed under Louisiana law. Federal law requires Jefferson Parish to provide Taxpayer Reporting Information 1099 forms to the Federal Government and the payee on certain types of payments. Click on link below to.

Please complete Request for Taxpayer Identification Number and Certification W-9 Form and return it to Jefferson Parish. 2-1-1 If you need assistance finding food paying housing bills accessing free childcare or other essential services during this time dial 2-1-1 to speak to someone who can help. A county-wide sales tax rate of 475 is applicable to localities in Jefferson Parish in addition to the 445 Louisiana sales tax.

350 on the sale of food items purchased for preparation and consumption in the home. 1855 Ames Blvd Suite A. 35 on the sale of prescription drugs and medical devices prescribed by a physician.

Which is much less than October 2021 standards within Jefferson Parish. In addition to sales tax food and beverage establishments in the City of New Orleans. Jefferson Parish has a lower sales tax than 61 of Louisianas other cities and counties.

This is the total of state and parish sales tax rates. Jefferson Parish exemption limited to purchase of. Questions or comments concerning the state sales tax exemption for food products can be directed to the Department of Revenues Taxpayer Services Division in Baton Rouge at 2252197356 or to one of the departments Regional Service.

Food and Drug Sales Column 1 35 Food Drug Column 2 475 General Column 2. Prospective restaurant nightclub or lounge owners should also contact their parish or municipal taxing authorities for information concerning local sales tax occupational license and other requirements. Groceries are exempt from the Jefferson Parish and Louisiana state sales taxes.

Which in fact may be between 2 and 3 in regarding the 3 5 Million Food Truck Food Truck 70003 Metairie Sunday March 27 2022 120000 AM. The 2018 United States Supreme Court decision in South Dakota v. The Jefferson Parish sales tax rate is.

You can find the SalesUse Tax Registration form there. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax. A county-wide sales tax rate of 5 is applicable to localities in Jefferson Davis Parish in addition to the 445 Louisiana sales tax.

Consistent With Louisiana Governor John Jefferson Parish Facebook

November Election Results For Jefferson Parish Wwltv Com

Bureau Of Governmental Research Backs Jefferson Parish Water And Sewer Tax Proposals The Latest Gambit Weekly Nola Com

Jefferson Parish Sheriff S Office Facebook

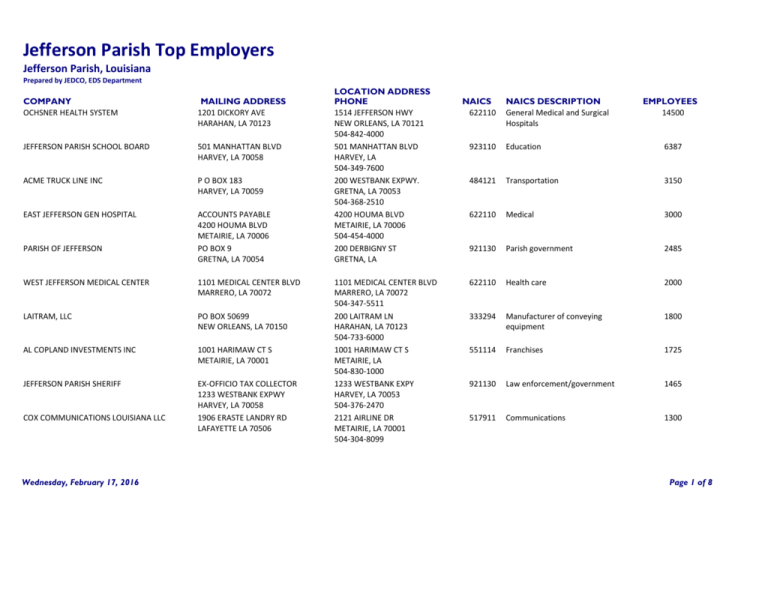

Jefferson Parish Top Employers

![]()

Jefferson Parish Sheriff S Office 23 Crime And Safety Updates Mdash Nextdoor Nextdoor

Economic Contribution Of Forestry And Forest Products On Jefferson Parish Louisiana

Stability Today Jefferson Parish United Way Of Southeast Louisiana Prosperity Dashboard

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Jefferson Parish Proud Jefferson Parish Facebook

/cloudfront-us-east-1.images.arcpublishing.com/gray/HVZBKS75QJAANKNYJQYTIAULGM.jpg)

Jefferson Parish Collected 323 152 Less In Taxes In June

/cloudfront-us-east-1.images.arcpublishing.com/gray/23RZJ3PAW5DK7CNEJ7LLJIQYLA.jpg)

Jefferson Parish Collected 323 152 Less In Taxes In June

Kids Eat Free Or Cheap Deals Nola Suburbs Kids Eat Free Kids Meals Jefferson Parish

Faqs Jefferson Parish Sheriff S Office La Civicengage

Tweets With Replies By Jefferson Parish Jeffparishgov Twitter

How Healthy Is Jefferson Parish Louisiana Us News Healthiest Communities