crypto tax calculator australia free

For more videos like this view the Playlist on our Channe. Canada was its first supported jurisdiction followed by the United States and now Australia with plans.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto.

. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. You can use our software to categorize all of your transactions and will only need to proceed to payment once you want to view your tax report. Australian Cryptocurrency Record Keeping Made Simple.

Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes. Since then its developers have been creating native apps for mobile devices and other upgrades. At Crypto Tax Calculator Australia we believe plans and pricing should be affordable no matter how much you are trading or the amount of transactions you.

If you hold your cryptocurrency for. Aggregate Your Exchange Data. View your taxes free.

Affordable plans for everyone. Tax Free Threshold Tax Refunds 101. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate.

Youll only start to pay Income Tax when you hit 18200 in total income per year. Zenledger is the fastest and friendliest tax software for cryptocurrency investors and accountants. What is a Crypto Tax Calculator.

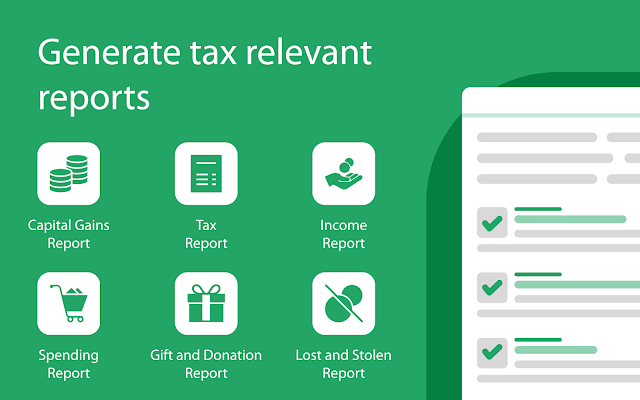

They compute the profits losses and. Is there a free trial I can try. In our Australian crypto tax guide we break down everything you need to know about crypto taxes including what you need to provide when you.

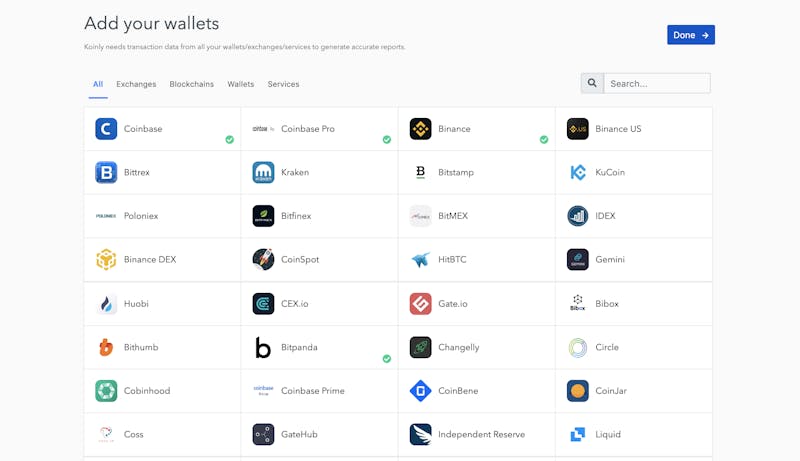

Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today.

Partnered with the largest tax preparation platform to. How to Pay 0 Tax on Cryptocurrency Gains in Australia Explaining the Personal Use Asset Method. Thats why it is a leading tax generator for retail investors.

CoinTrackinginfo - the most popular crypto tax calculator. The original software debuted in 2014. Sign In with Google.

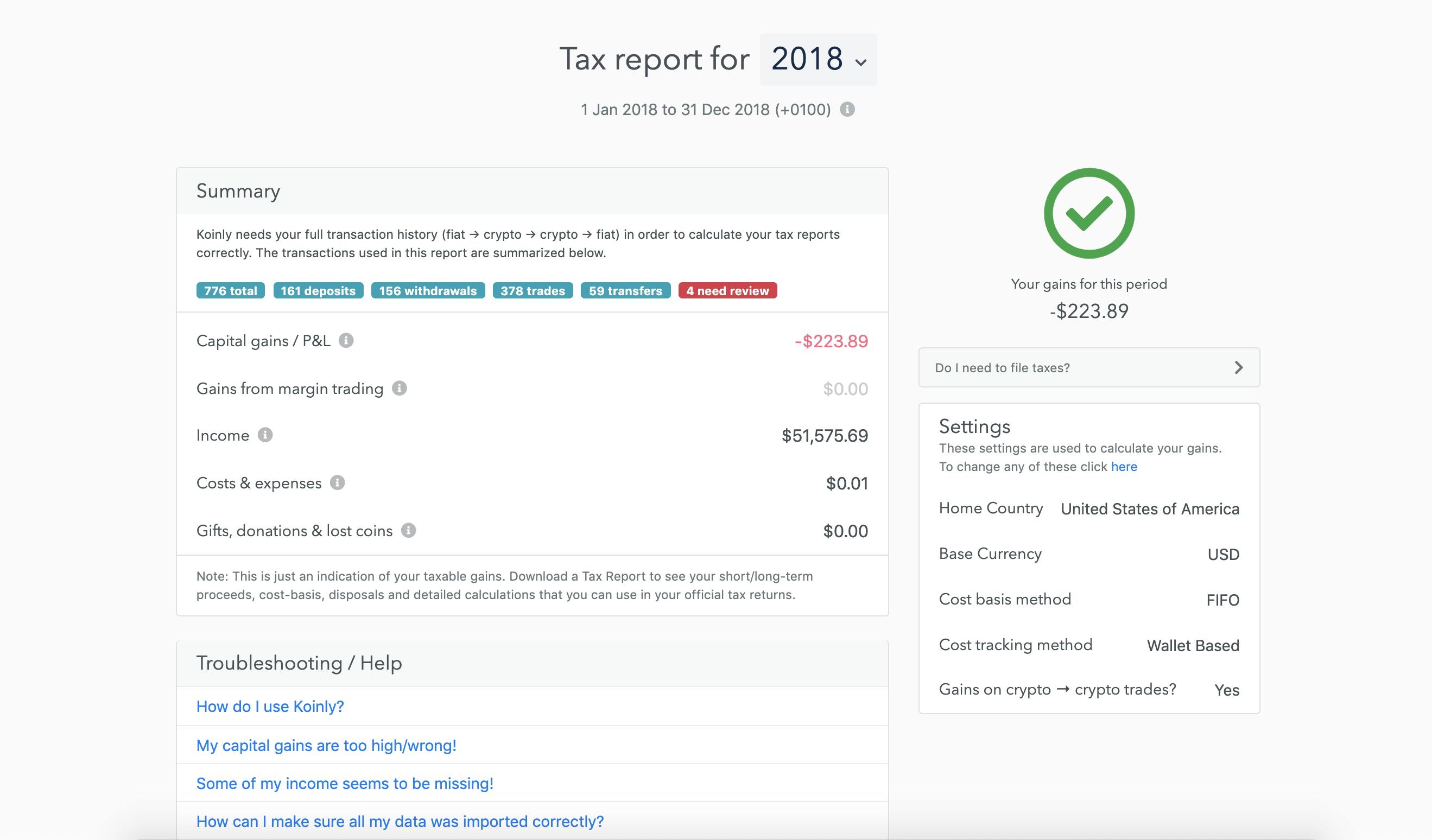

Download your completed IRS forms to file yourself send to your accountant or import into software like TurboTax and TaxAct. How Koinly Crypto Tax Calculator Can Help. 50 Capital Gains Tax discount.

Calculate your Crypto Taxes in Minutes Supports 300 exchanges ᐉ Coinbase Coinspot Coinjar Compliant with Aus. Or Sign In with Email. Crypto Tax Calculator who we recommend for our existing users.

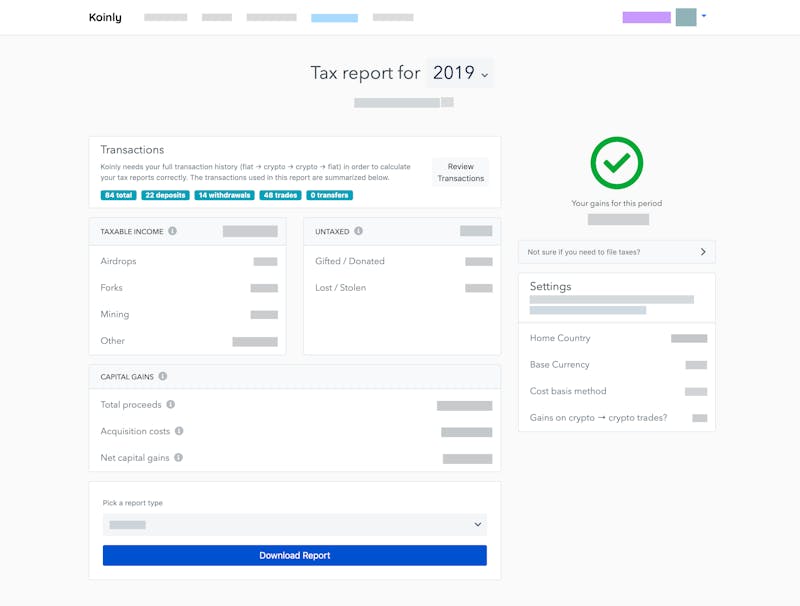

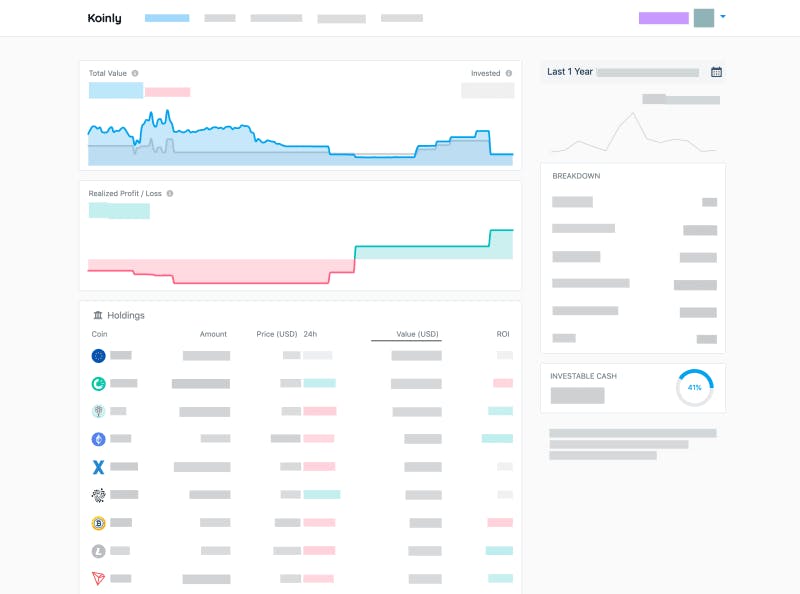

Koinly Crypto Tax Calculator For Australia Nz

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

![]()

Cointracking Crypto Tax Calculator

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

Declare Your Bitcoin Cryptocurrency Taxes In Australia Ato Koinly

Crypto Tax In Australia The Definitive 2021 2022 Guide

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Crypto Tax In Australia The Definitive 2021 2022 Guide

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Crypto Tax In Australia The Definitive 2021 2022 Guide

Koinly Crypto Tax Calculator For Australia Nz

![]()

Cointracking Crypto Tax Calculator

Best Crypto Tax Software Top Solutions For 2022

Koinly Crypto Tax Calculator For Australia Nz

Cryptoreports Google Workspace Marketplace

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Cryptocurrency Tax Software Crpytotrader Tax Now Available In Australia Bitcoin Com Au